Home › Industries › Energy and Utilities › AI-Driven Risk Analysis: Automating Compliance with the Audit AI – Risk A...

About the Client

The client is one of the top five world-leading oil and gas enterprises, with extensive upstream, midstream, and downstream operations across global markets. It operates in more than 180 countries. Managing large volumes of financial records, audit documents, contracts, and material data on a daily basis, the organization operates at a scale and complexity that necessitates strict regulatory compliance, financial transparency, and operational efficiency. AI-driven risk analysis plays a crucial role in helping the client meet these demands by enabling more accurate, efficient, and proactive management of risk across all operations.

Business Challenges

As organizations seek to modernize compliance and risk management, automating the categorization and risk rating of data has become a key priority. Traditional manual processes are often time-consuming and dependent on individual expertise, making them less efficient and prone to inconsistencies. GenAI for risk management leverages advanced technologies, including generative AI and natural language processing, to streamline these tasks and enhance accuracy.

Solution

To address the challenges of manual risk categorization and data profiling, an automated and intelligent solution is essential. AI-driven risk analysis leverages advanced AI technologies to streamline these processes, improve accuracy, and support risk analysts in making informed decisions.

Develop a reusable component for automated data profiling and categorization.

Implement a GenAI-powered solution capable of assigning ratings and categories based on document features (such as descriptions or IDs) and historical data mapping.

Automate the process of defining categories by learning from past data patterns.

Assign risk ratings dynamically according to the identified categories.

Provide an AI-driven assistant that supports risk analysts and can be easily scaled to accommodate evolving business needs.

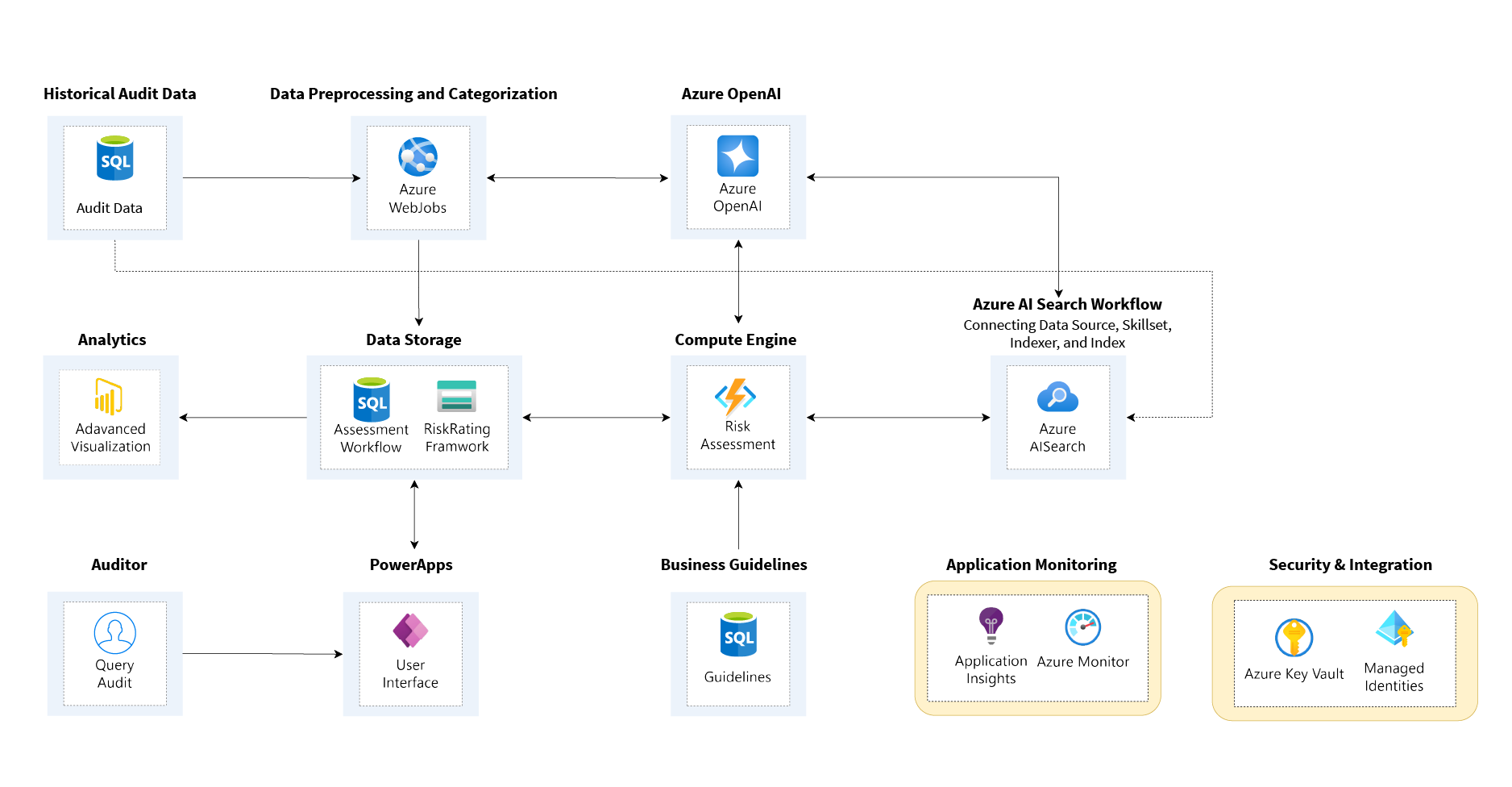

Risk Analyzer Technical Architecture

Figure 1: Risk Analyzer Technical Architecture

Tech Stack

| Programming Languages | Python for machine learning models, Azure SDK, scripting, and SQL for database queries and data management. |

| Azure Cloud Platform | Azure Cloud Platform, Azure Blob Storage, Azure Functions, Azure Machine Learning, Azure OpenAI services, Azure SQL Database, Azure AI Search, Azure Key Vault, API Management, and GitHub. |

| IDEs | Visual Studio Code for Python and Azure function development and Azure Machine Learning Studio for building and managing ML models. |

| Other Components | Azure SDKs for Python, Scikit Learn, Azure Cognitive Services API, Azure Logic Apps, or Data Factory. |

Business Benefits

Implementing automation in risk assessment and audit processes delivers measurable improvements in efficiency, consistency, and overall quality. GenAI for risk management streamlines manual tasks and leverages data-driven insights, enabling organizations to accelerate decision-making and empower teams to focus on strategic priorities.

Automated risk scoring and calibration significantly reduced manual effort.

Provided consistent, data-driven risk assessments across all audit findings.

Reduced turnaround time from days to minutes for each finding.

Saved over 1,400 person-days annually, enabling auditors to concentrate on strategic analysis and remediation planning.

Enhanced audit quality, coverage, and agility without increasing headcount.

Conclusion

The implementation of the Audit AI – Risk Analyzer solution marks a significant step forward in automating and optimizing risk management processes. By leveraging GenAI, natural language processing, and scalable Azure services, the solution streamlines data categorization and risk rating, reduces manual effort, and enhances the accuracy and consistency of compliance operations. This innovative approach empowers risk analysts to focus on higher-value tasks, supports better decision-making, and ensures the organization remains agile and compliant in a rapidly evolving regulatory landscape.

Testimonial

“Our team’s approach by leveraging GenAI and automation transformed the client’s audit and finance operations, enabling full document coverage and smarter risk analysis. Audit AI – Risk Analyzer saved over 1,400 person-days annually delivering consistent, data-driven insights for faster, smarter compliance decisions. This achievement reflects our commitment to delivering practical, future-ready solutions that drive measurable value for supermajor oil & gas companies.”– Assistant Vice President, Energy & Utilities, LTIMindtree

Ready to transform your risk management and compliance processes with AI-driven automation?

Connect with our team at eugene.comms@ltimindtree.com to discover how Audit AI – Risk Analyzer can help your organization achieve greater efficiency, accuracy, and compliance.